Financial planning and tax management have taken the front seat as we enter the new fiscal year. While preparing for 2021, investing in a plan such as a Flexible Spending Account (FSA) or Health Savings Account (HSA) can help you maximize tax savings.

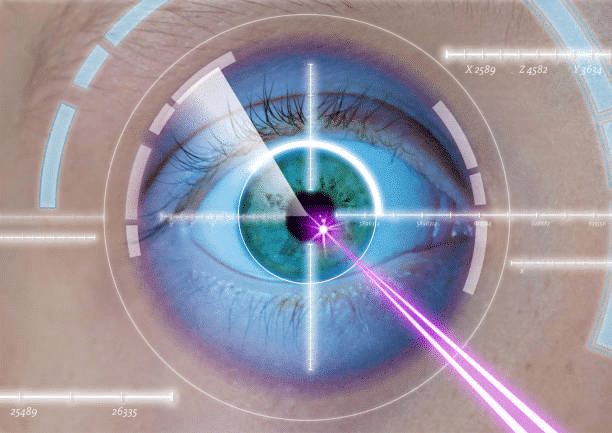

More importantly, the Internal Revenue Service (IRS) has declared that these accounts can help you cover the expenses of eye surgery and vision correction procedures such as LASIK. HSAs and FSAs are acceptable tax-saving options and long-term investment plans to help you save money on a lifetime of eye-care expenses.

What Are HSAs and FSAs?

HSAs and FSAs are tax-exempt savings accounts that help you save a portion of your pre-tax income for future expenses. These funds can be used for out-of-pocket expenditures for eye surgery and healthcare. The two accounts vary and have different contribution limits.

In 2021, the IRS has declared new limits for these accounts, and the contribution deadline has been extended to May 17, 2021, due to the COVID-19 pandemic.

HSAs

To create an HSA, you must have a high-deductible health plan. The contribution limit for an HSA has been increased by the IRS to $3,600 per individual and $7,200 per household.

An HSA is a flexible plan that you can set up, own, and carry forward in case of an employment change. It permits the rollover of unused savings every year, which lets you accumulate funds until you need them.

FSAs

An FSA can only be set up by your employer, and its contribution limit is $2,750 for an individual.

Unlike an HSA, an FSA does not allow the rollover of savings to the next year. You must use up your FSA funds before the year ends or else they expire. If provided by your employer, some plans allow a delay in using the money with a 2.5-month grace period.

With an FSA, you can access the full annual contribution at a tax advantage.

Using an HSA/FSA to Pay for Eye Surgery

Although the IRS has set some restrictions, HSAs and FSAs can cover expenses for eye procedures ranging from LASIK and PRK to surgeries for cataracts and glaucoma.

Complicated eye surgeries can be expensive, especially if they require advanced machinery. An FSA contribution may not be enough to cover the complete cost of the procedure. In such cases, ask your employer whether the previous year’s FSA plan allows a grace period. You can then combine that amount with funds from your current plan to meet the cost.

In contrast, an HSA allows you to access your funds without a time limit. You can keep contributing to the account and opt for eye surgery once there is sufficient money.

If you have an FSA and HSA, you can use them together to help cover eye surgery.

Planning for Eye Surgery

With HSAs and FSAs, you can easily plan ahead for life-changing eye surgery and schedule it pre-tax. However, you must be aware of the maximum contribution limit, healthcare policy, conditions, and a grace period of the FSA offered by your employer.

HSAs offer considerable flexibility, allowing you to schedule an eye procedure when you have enough funds. But FSAs require you to use up your contribution before the year ends.

Now is the right time to schedule a consultation with the most trusted eye surgeons in Las Vegas at Brimhall Eye.